- Automation in Finance and Accounting

- Frequently Asked Questions

Automation in Finance and Accounting

Automation in finance and accounting is a key metric to business success, achieved by reducing repetitive administration tasks and ensuring data is consistent and error-free. Irrespective of your industry specialism or company size, finance and accounting processes are a vital element of your business. In many cases, finance and accounting is often one of the first business functions to be scrutinised when business goals, objectives and strategies are evaluated. Business leaders expect the finance and accounting department to run as efficiently as possible to ensure that payments are processed quickly, debtors are chased, and reports are created on time to share insights and aid decision making.

The following article provides you with an overview of finance automation, planning your digital transformation in finance project, as well as some automation ideas in finance to help provide you with a competitive advantage and exceed your long- and short-term business goals and objectives.

Learn about automation in finance

What is automation in finance?

The meaning of automation in finance and accounting is the use of business process automation software to reduce repetitive manual administration tasks, such as bank reconciliation, credit control and expense management from employee workloads. Business process automation software brings systems and data together to streamline critical financial data processes. Manual business processes can be time-consuming and prone to errors, which can cause process bottlenecks, indecision, and impact company cash flow.

Finance automation software can alleviate these pain points. Removing the reliance placed on employees to manually process data across multiple business systems enforces compliance and improves the consistency of your business data and processes. In turn, this helps to maintain professional relationships with trading partners and customers to drive the company forward.

Common finance and accounting processes that are often automated include:

- Journal entries

- Bank reconciliation

- Expense management

- Credit control

- Financial reporting

Finance automation key identifiers

In many instances, organisations turn to automated finance processes when they identify that data is being held in multiple business systems and databases. This means that employees must collate data from different data sources and re-input this information into another database or report. Unfortunately, this is an inefficient use of employee time and resource, which is prone to error and is an unnecessary cost to the business. It’s worth investigating implementing business process automation solutions that can bring systems, information and people together when you see some of the following pain points:

- Regularly identifying missing payments

- Incorrectly overcharging or undercharging customers

- Reduced employee productivity due to missing data, or data being held in multiple databases or spreadsheets

- Poor and inconsistent reporting to senior management resulting in poor decision making and planning

- Dealing with new and existing customers with a bad credit history, putting the company at financial risk due to non-payment

Importance of automation in finance

Automation in finance plays an important role for an organisation and is a key driver for moving the company forward. It’s the backbone of the business, with C-level executives, sales, marketing, human resources, customers, suppliers and auditors all being reliant on the financial information provided. This means that all financial data must be free from error, up to date and presented to the right people at the right time.

One of the biggest contributors to poor cash flow is the ineffective management of essential processes and administration tasks that often reside in the accounting and finance department. Cash flow enables businesses to stay afloat and provides the capital needed to pay suppliers and invest in business-critical assets, such as inventory or new equipment. If an anomaly appears within a finance and accounting process it can have a significant effect. This can include coming under scrutiny from regulators and, in the worse-case scenario, the organisation entering receivership and going out of business.

Automation in finance and accounting helps organisations ensure that their finance processes are efficient, accurate and delivered on time, removing added strains placed on employees. Common reasons why automation in finance is important in business include:

- Reduced risk of being exposed to fraud and credit risk

- Reduction of manual data entry tasks and related human error

- Increased speed in processing financial data

- Improved decision making due to reports being correct, up to date and delivered on time

- Improved compliance procedures

When planning the first stages of your digital automation and transformation in finance and accounting strategy, it’s advisable to consider the following aspects to help you on your journey.

- Educate and research common automated processes within the finance and accounting function

- Start small and then increase the number and complexity of automated processes

- Involve employees and key decision makers in the process

- Build your digital transformation team to help you plan and execute your strategy

- Research business process automation software that has proven knowledge and experience in automating business processes and integrating business systems

Learn about automation in finance

Digital transformation in finance and accounting

Digital transformation and process automation in finance and accounting provides you with the ability to firmly establish business goals and objectives. Digital transformation and the finance function isn’t just about finance technology and how it can be used to automate finance processes. It is a means of adapting existing manual business processes to align with digital technology, making a business leaner and more efficient. Digital transformation in finance is part of a wider business strategy in which an organisation adapts and shifts the culture of the way it is run, whether this is the way people are deployed, suppliers are managed or customers are serviced.

Digital transformation in finance comes with its challenges, but also brings additional opportunity. Adapting finance processes, working culture and accounting systems within an enterprise organisation is far more challenging than to a business with 50 employees. Irrespective of size, most organisations can struggle with the strategic planning that surrounds digital transformation and can easily rush into purchasing business systems without any clear objective or process-aligned objectives.

Planning your digital automation and transformation in finance strategy can take time and involve numerous employees in the planning phase. Common areas for consideration when planning your digital transformation project include:

- Set clear business objectives

- Identify existing processes and align them with business objectives

- Ensure that the business objectives and proposed transformation changes will deliver the desired business benefits

- Outline and execute a rollout programme

- Monitor and report on success that has been achieved against the initial expectations

One of the first steps to take in planning your digital transformation roadmap is to establish the areas and processes that you would like to improve. An example has be outlined for you below.

| Business Objective | Business Benefits | Primary Risks |

|---|---|---|

| Enable customers to self-service | Reduce costs | Customers might prefer speaking to a person |

In order to help you plan your digital transformation in a finance project we have created a digital transformation roadmap that includes your own project-planning workbook which is available for download below.

Download Digital Transformation Roadmap

Process automation in accounting and finance

Business process automation in accounting and finance has fast become an essential tool to improve productivity and increase company output. Deciding on the finance processes that you would like to automate can initially seem like a challenging task to perform. One of the first steps in determining your process automation strategy is to understand your business requirements and needs. It’s beneficial to research business processes that other organisations have automated and the common manual tasks that are most often automated.

To help you start planning your digital transformation in finance journey, we’ve put together some common automation use cases in finance, such as record to report and credit control that our customers often implement:

Journal entry automation

Journal entry is a time-extensive strain on employees which can require the completion of data validations, error corrections and approvals to be uploaded to an ERP system. This manual process can lead to delays in collating data from numerous sources throughout the business, which could result in failing to meet essential deadlines.

Journal entry automation provides you with the ability to automatically create, update and approve journals which can be dynamically inserted to your general or sub ledger system or ERP solution. In addition, automating journal entries removes the risk of missing documentation and making estimates based on old assumptions. Having the ability to automate journal entry posts based on business rules and data reduces the risk of errors and manual data entry tasks to improve company performance, aid decision making and achieve an audit trail.

- Automatically create, update, and approve journal entries

- Automated PO accrual process

- Automatically upload journal entry posts to general or sub ledger system or ERP solution

- Achieve audit trail 100% of the time

- Store supporting documentation digitally

Learn about automation in finance

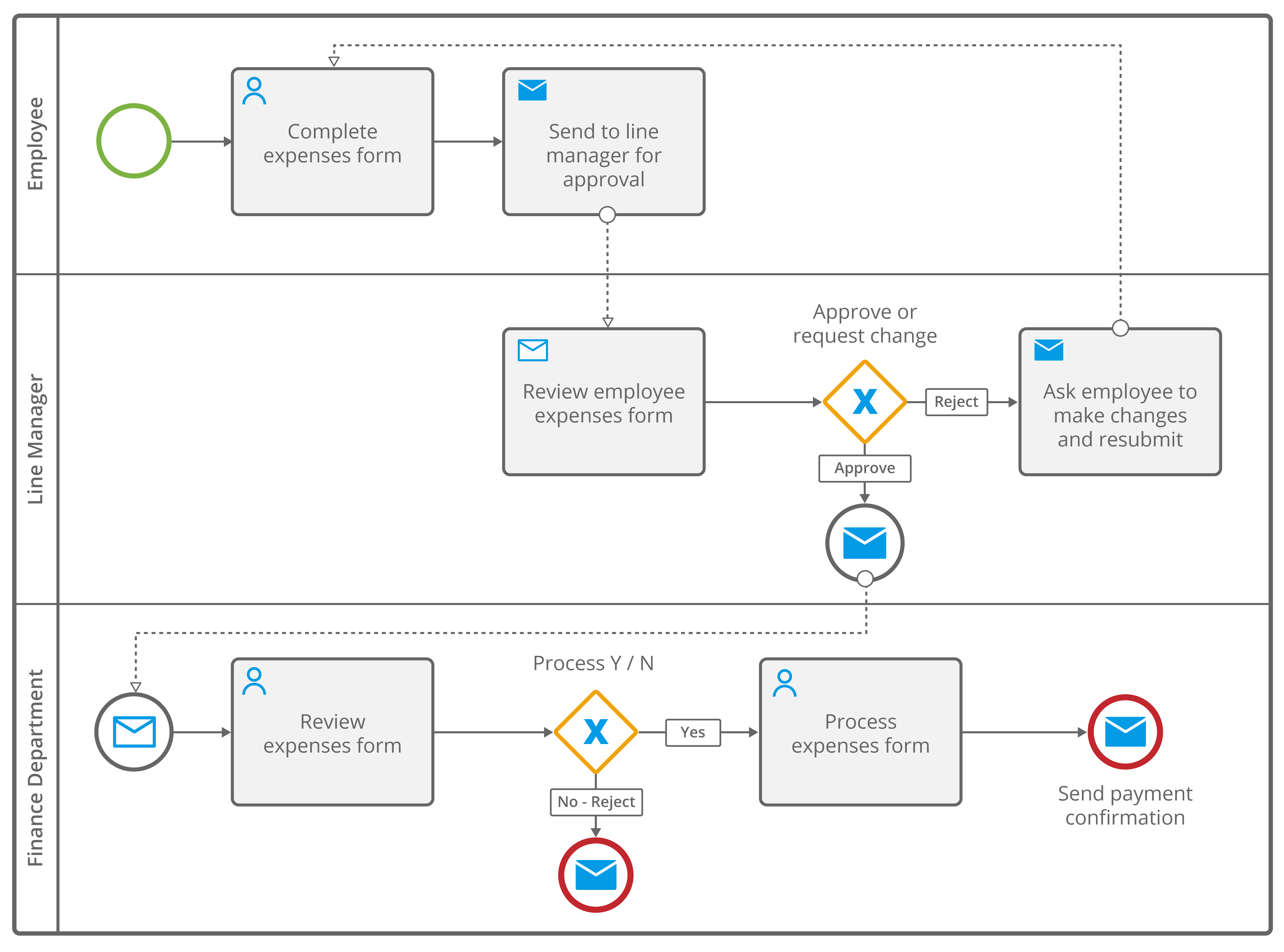

Expense management automation

It’s commonplace for expense management processes to be manual tasks, such as an employee processing expense claims by tracking employee spend and reimbursing the costs incurred for travel or for company invoices. This manual approach can require paper tracking for receipts and the management of spreadsheets for expense reports which causes the process to be time-consuming and prone to error.

Expense management automation removes these manual processes from employee workloads by integrating an expense management system, such as SAP Concur and Expensify that collects, stores, processes and reports on employee and business expenses, and then automates the transfer of this data to other business systems. Expense automation reduces the need for employees to manually track receipts, invoices and payments and removes manual processing errors. Common expense management automation processes include:

- Integration with ERP systems, e.g. SAP Business One, Sage, Microsoft Dynamics, Access Dimensions, SYSPRO etc.

- List item synchronisation, e.g. for cost centres, profit centres, expenses for a specific project

- Invoice automation

- Automated expense reports

- Automatic scheduling of supplier payments

- Automated creation of general ledger entries

Image: Expense management automation process flow example

Intercompany management automation

Whether your organisation is trading with multiple subsidiaries or business units, intercompany transactions can increase the strains on employees due to the complexity and time-extensive tasks. Employees often manually work around foreign exchange differences, timing delays and different accounting and finance systems, which can create disputes over pricing and incomplete documentation when creating accruals and balance journals. Additionally, they may encounter issues when record to report process deadlines are approaching.

Intercompany process automation removes the manual processes that surround financial consolidation and intercompany procurement between two or more businesses. Automating intercompany transactions provides you with the ability to reduce errors from manual processing and increase productivity across all business entities.

Example intercompany trading processes that can be automated include:

- Automated transfer (and transformation) of financial data between company finance systems

- Automatic creation of purchase orders, invoices and payments

- Intercompany reconciliation

- Automated transfer (and transformation) of industry or company specific data, e.g. supplier or product codes between company business systems

- Consolidation of master files, e.g. CRM or supplier data

- Automatic creation and delivery of data-driven or scheduled reports

- Real-time notification of data changes via email or SMS

- Automatic creation of workflow approval processes

Learn about automation in finance

Financial close checklist automation

In many cases, the financial close checklist process is still a laborious task for many employees who rely heavily on spreadsheets. Unfortunately, keeping important business data on local spreadsheets means that critical information is disconnected from other financial tasks. The manual complexities of completing tasks and coordinating related activities across the business in spreadsheets can result in data errors and processing delays that miss deadlines.

Financial close checklist automation provides you with the ability to achieve a complete audit trail of financial close events to increase the visibility of disparate information, improve speed and efficiency, and reduce administration errors. Common automated close checklist requirements often implemented by our customers include:

- Automatic creation of close checklists

- Automated scheduling on time and date

- Automated database triggers based on business rules from existing systems

- Financial checklist workflow approval for single and multi-level authorisations

- Data integration with other business systems, e.g. SAP Business One, Oracle E-Business Suite, Microsoft Dynamics, Sage, SYSPRO, Epicor etc.

- Dynamically attach and upload relevant documents to related task list items e.g. policies and procedures

- Automatic notifications via email or SMS sent to relevant parties to view and complete tasks

Balance sheet reconciliation automation

Balance sheet reconciliation plays a vital role within an organisation. In many instances within a business, this process involves the use of spreadsheets which are prone to administration errors and is time-consuming to update and maintain data consistency. Employees manually collate and extract data from existing systems, such as ERP software, online bank statements and other business database applications, to then identify and report on discrepancies that need further investigation. Relying on employees to concentrate on obtaining the correct information increases the risk of missing critical information and restricts visibility and control throughout the reconciliation process.

Automated balance sheet reconciliation enables you to standardise data documentation to improve data accuracy, increase visibility and reduce financial risk. Common balance sheet reconciliation automation solutions often sought after include:

- Integration with ERP and accounting systems

- Automatically match transactions against a general ledger

- Automate single and multi-level approval workflows

- Automatically update related corrections and journals into your ERP system

- Dynamic comparison of account balances between multiple data sources and identify discrepancies

- Automatic alerts and notifications via email/SMS to employees regarding discrepancies

Credit control automation

The ineffective management of credit control processes can be one of the major factors to poor company cash flow. Credit control teams ensure that processes and procedures are adhered to, helping to maintain consistent cash flow and reduce debt recovery. However, credit control processes can be time-consuming, prone to errors and a costly administration process.

Credit control automation can ensure that business rules are adhered to, employee errors are removed, aged debtor times are reduced and cash flow is consistent. It will also relieve finance teams of repetitive administration tasks, improving their productivity. Common automated credit control processes include:

- Automate the creation and delivery of credit control letters or emails to business rules

- Automate the creation and delivery of invoices and statements

- Automatically inform non-financial team employees of credit control status changes via email or SMS, e.g. account placed on credit hold

- Schedule debt collection phone calls

- Automate alerts for unallocated invoices

- Automated aged debtor reports

Download the eBook below to find out more on how automating credit control processes removes employee errors from repetitive administration, reduces aged debtor times and improves company cash flow.

What are the benefits of finance automation?

Implementing finance automation solutions provides you with the opportunity to align multiple business processes and procedures to streamline operations and reduce costs. From utilising the digital transformation and automation in finance and accounting workbook within this article you will be able to highlight the key processes, procedures and roles that can be improved by implementing finance automation software.

Automation in finance connects disparate information so that your business runs efficiently, whilst saving administration costs. Automation can include the creation and delivery of critical processes such as preparing statements, account reconciliation, data entry and intercompany management. Typical benefits of automation within the finance function include:

Improved financial data accuracy

Office automation in finance improves data accuracy by removing repetitive manual administration tasks from employee tasks. Finance system integration synchronises critical data between databases, reducing the risk of human error and making processes quicker and easier. Finance automation tools ensure that data is consistent across all relevant systems involved in the process. This means that any data changed will correlate throughout the business.

Faster processing

Business automation software for accounting and finance enables your business to become leaner and act quicker to business demands. Decisions are made faster through automated workflow approval software, which removes employee time from sorting through emails and differentiating data held within accounting and finance systems. Processing times are reduced resulting in accurate and timely debt chasing, and assisting in automatically notifying associated personnel of impending and important dates. Reducing the administrative burdens often placed on time-starved employees ensures that existing processes are actioned when required.

Increased data visibility

Technology and automation in finance enables organisations to stay on top of critical financial and accounting data. Increasing data visibility means that financial and accounting data can be used across the business and be processed more efficiently. Providing employees with data rich information as and when they need it improves strategic decision making to drive the company forward.

A platform for digital transformation

Business automation software for accounting and finance provides you with a platform for digital transformation opportunities across the organisation. Business process automation software provides you with the added ability to integrate systems and automate practically any business process quickly and easily to improve the way the whole business operates. BPA software can be added to eCommerce processes, procurement, warehousing and sales and marketing activities to remove manual administration from routine tasks that cost time and money. Freeing up valuable resources in multiple areas of the business through digital transformation software enables business leaders to utilise employee talent in areas where they can provide additional value, such as growing customer and supplier relationships.

Learn about automation in finance

How to automate accounting and finance processes

Codeless Platforms’ BPA Platform provides you with drag and drop business process automation tools that can integrate your existing business systems and automate manual processes.

Codeless Platforms has a proven track record in BPA Project Management, delivering system integration and automated processes that help organisations get the most from their data. Our highly skilled professional services team are business process experts and have a wealth of knowledge and experience in working with a wide range of industries and business systems and applications from software vendors such as SAP, Microsoft, Sage, Access Group, Epicor, SYSPRO and many more. In addition, we work closely with our global channel partners that can help plan, build and deploy BPA Platform to your exact requirements.

For more information on how automation in finance and accounting can help your business, download the brochure below or call us on +44(0) 330 99 88 700.