- Planning a business strategy during recession

- Examples of survival strategies in business

- Frequently Asked Questions

Planning a business strategy during recession

Having a robust business strategy during a recession is a fundamental way to overcome the countless challenges that are thrown at today’s business leaders. With the right business recession strategy in place, it is possible for businesses of all sizes and industry specialisms to thrive during a recession and forever changing economic climates. Business survival strategies during a recession will help you to review what is working for you now, before, during and after a recession.

Preparing IT systems and investing in digital transformation solutions, such as business process automation software, will alleviate the impact that a recession may have on your business and ensure that you are positioned to operate effectively with minimal interruption. Effective planning and implementation of your business strategy during a recession is key to employee retention, sustainability within your marketplace and balancing cash flow.

A recession can be caused by several different influences that can have a ripple effect on the wider economy. Some common reasons for a recession include:

- Manufacturing – a slow decline in manufacturing output

- Retail and wholesale sales drop

- Employee salary and income stagnates

- Employment levels fluctuate

- Inflation of goods and services and interest rates

- Unforeseen global circumstances, e.g. COVID-19

“The value of digital channels, products and operations is immediately obvious to companies everywhere right now. This is a wake-up call for organizations that have placed too much focus on daily operational needs at the expense of investing in digital business and long-term resilience. Businesses that can shift technology capacity and investments to digital platforms will mitigate the impact of the outbreak and keep their companies running smoothly now, and over the long term.”

Sandy Shen, Senior Director at Gartner

During a recession, it’s common practice for companies to turn to retrenchment approaches to business strategy. This approach highlights reduced costs, streamlined product offerings and the restructuring of day-to-day business processes and employee tasks as areas where improvements are needed or where cost-saving changes can be made. Although changes can be made to day-to-day business processes to remove repetitive data entry administration and other manual tasks within a business, digital transformation removes the pressures placed on employees which can enable them to concentrate on other areas of the organisation, such as improving client relations. Business process automation also alleviates the pressures of having to recruit seasonal employees during peak periods helping you to balance cash flow accordingly.

To help you start planning your economic downturn strategy and to navigate the difficult business decisions that will help you to maintain financial security and planning during unknown times, download the BPA Project Management Process Workbook and use it as a guide to get started.

Examples of survival strategies in business

Recession Business Strategy – Aligning business processes

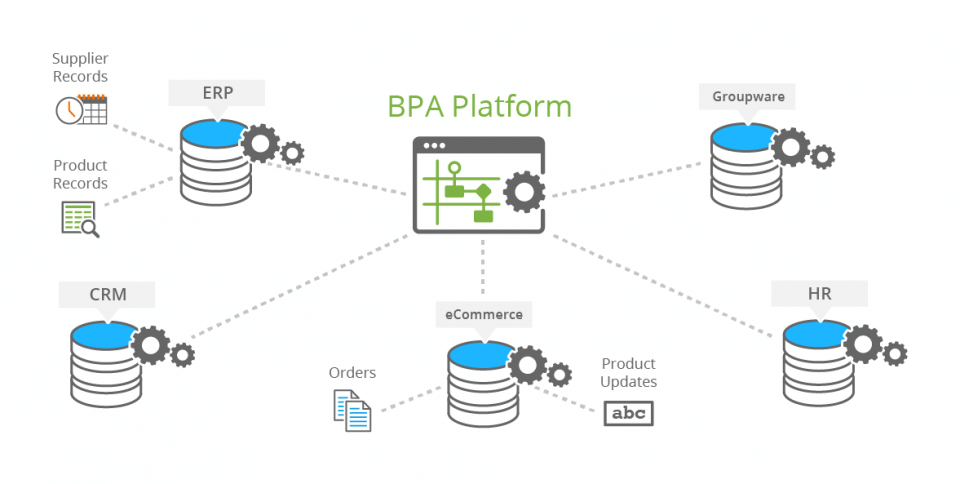

Business process automation solutions provide organisations with the ability to streamline day-to-day business operations and manual tasks to help them overcome the challenges faced by an economic downturn. Data entry automation removes repetitive and time-consuming, manual data entry tasks from employee workloads which, in turn, results in cost reduction and increased profitability.

According to Forrester, business process automation can dramatically reduce manual administration and cut operational costs by up to 90%. Introducing digital transformation into your recession business strategy can ensure that your internal processes have a significant impact on the way a business operates. For example, data entry activities can be streamlined, eCommerce order management processes can be automated and credit control tasks can be simplified.

“I always equate BPA Platform to being a staff member that never sleeps. It’s like an incredibly efficient person, or team of people, checking data, that never stops.”

Malcolm MacLean, Global Head of IT, Graff Diamonds. Read the case study

Simplifying business processes through process automation not only ensures that data is consistent and up to date, it also delivers an instant ROI and protects a business against financial risk. Digital transformation through data entry automation and business activity monitoring software acts as a virtual employee that works continuously 24/7, 365 days a year, automating practically any number of employee-driven processes, in turn saving you time and money whilst driving company revenue and keeping overheads to a minimum.

Diagram: Example of how business process automation software sits in between business systems and applications to automatically synchronise data.

There are many ways in which a business can use digital transformation to its advantage by streamlining day-to-day employee-driven tasks. For an extensive list, download the 200 ways to use BPA Platform brochure to receive an in-depth resource to start your digital transformation journey.

How to protect cash flow during a recession

It’s important for all businesses to protect cash flow and ensure that it is consistent. Cash flow is the lifeblood of an organisation and enables businesses of all sizes to operate effectively by ensuring that capital is available to pay suppliers and invest in technology, equipment and inventory. Issues with cash flow may occur if outgoing payments, such as the rental payments for office space, employee salaries and production costs, outweigh incoming payments. This makes it key to keep an eye on cash flow and the impact it may have on your business.

Ensure that protecting cash flow is at the top of the list for business survival strategy during a recession. Cash flow management can be the difference between an organisation surviving or entering receivership and going out of business.

One of the key areas where you can ensure that cash flow is maintained is improving the management of your credit control process. It will help to ensure that cash flow is consistent and the cost of debt recovery is reduced.

Common factors that can weaken cash flow and credit control processes include:

- Absence of key employees

- Sales team applying pressure on accounting and finance teams to loosen customer credit limits

- External factors such as the absence of employees at a client site where they are responsible for payment of invoices

- Economic events within your marketplace

Protecting cash flow with credit control automation

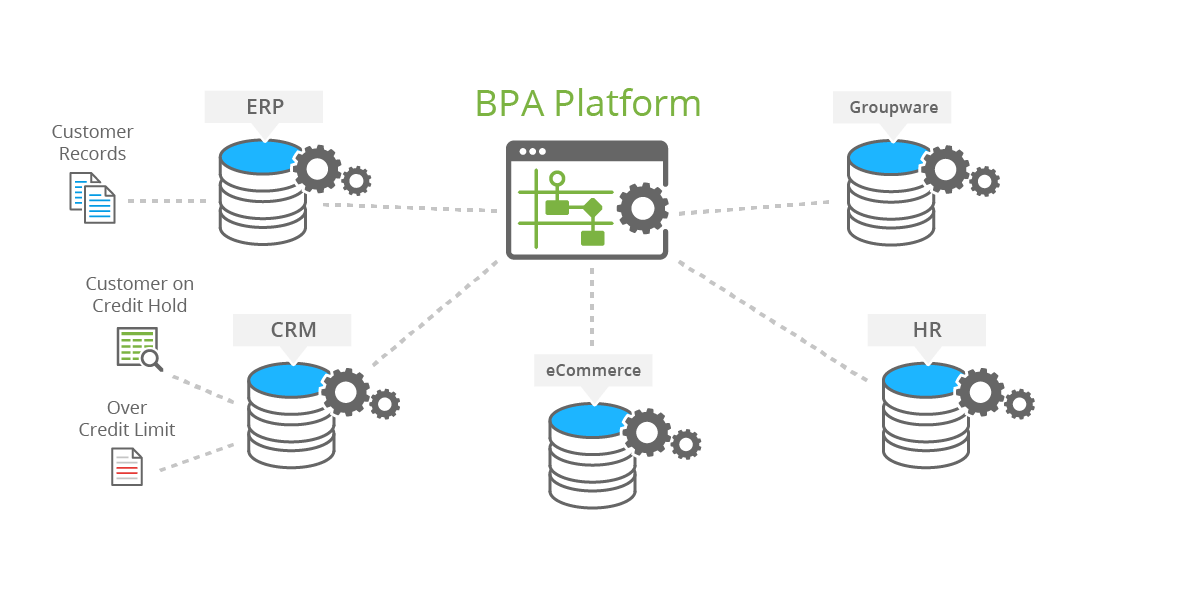

Business process automation solutions will enable you to successfully reduce the time-consuming and error-prone manual processes that surround credit control within your accounting and finance department. Process automation will act as additional cover for employee absence and ensure consistency within essential employee-driven tasks.

Organisations that have automated credit control processes cite seeing debtor repayment cycles reduce by at least 2 weeks and the costs associated with this activity slashed by around 80-90%. Common credit control automation processes that can be implemented to improve consistency include:

- Automating the creation and distribution of financial reports

- Automatic creation and delivery of debt management activities, e.g. monitoring and email reminders

- Automating the creation and distribution of invoices and statements

- Credit limit workflow approvals for placing clients on hold, receiving bad credit communications or for credit limit amendments

- Accounting software integration with online data services such as Creditsafe to receive the most up-to-date credit referencing data and Companies House for up-to-date company information

- Automated credit control SMS communications

Diagram: Credit Control Automation Example – Customer Account Placed on Credit Hold.

The key to healthy cash flow is to consistently enforce credit control procedures, such as setting clear credit limits, agreeing mutual customer payment terms and having the ability to effectively send invoices and chasing all debtors when payment is due or overdue. Staying on top of customer payments will aid the process whilst reducing credit to bad debtors, help ease cash flow and help you to do business with creditable organisations.

Download 200+ Examples Download Workbook

Dynamic database activity monitoring

Another key area to consider when compiling your business survival strategies is the introduction of IT process automation (ITPA) and database activity monitoring tools. Business activity monitoring software provides you with the ability to automatically monitor multiple data sources and changes to data within a specific business rule. Business activity software can then trigger the delivery of information through email or SMS alerts and notifications in real time. This means that organisations reduce employee time in manually monitoring database changes which speeds up processes, ensures data consistency and removes the risk of errors.

Business activity monitoring solutions and ITPA Tools can provide rules-driven alerts and reporting functionality, such as:

Automated Alerts and Notifications

Implementing business activity monitoring tools is a great way for organisations to monitor, enforce and action common employee tasks that impact on company performance. These instances can include:

- Aged debtors totalling X days overdue or X amount owed

- Low or high stock level warnings

- Unauthorised sales discounts

- Incomplete compliance procedures

- Sensitive data monitoring, e.g. payment account details

Report automation

Reporting plays a critical role within an organisation. Consistent reporting ensures that compliance procedures are consistent and adhered to and that decision-makers have the most up-to-date and relevant information available to drive the company forward. Unfortunately, report creation is heavily reliant on employee interaction, it’s time consuming, prone to error and repetitive. Report process automation means that employee time can be allocated elsewhere, making them more productive instead of wasting time looking for potential errors or miscommunication. Typical reports automated by businesses include:

- Stock management reports, e.g. sold, in-stock, low-stock, volumes etc.

- Departmental budgets

- Financial reports

- Marketing campaign reports

- Sales reports, e.g. sales per month, pipeline, account manager KPIs etc.

Business activity monitoring software allows you to include monitoring capabilities to your existing business solutions and provide unique benefits to match your business objectives.

Common benefits of business activity monitoring software include:

- Real-time identification and notification of business risks across critical business systems and departments

- Improved decision making with up-to-date and relevant information delivered internally and externally through email or SMS

- Enforced company procedures

- Removal of human error and associated financial risk

“Business process automation can dramatically reduce manual administration and cut operational costs by up to 90%”

System Integration strategy examples and benefits

Streamlining business processes can be achieved through integrating existing business systems and applications. It allows businesses to cost-effectively reduce employee workloads by automatically synchronising data between disparate databases to improve data consistency and removing the need for employee intervention.

Common data integration strategy examples and benefits that businesses can achieve include:

- ERP eCommerce integration: Remove repetitive bi-directional data entry, automate the placement of orders with preferred couriers and increase the visibility of stock levels

- Accounting software integration with credit referencing applications: Ensure that you are dealing with high value, reliable customers with a reliable credit history. Automated reports, invoices and other critical documentation

- Warehouse Management System integration: Automate the placement of orders with courier services, automate stock level alerts, delivery notifications and automate pick lists without employee intervention

- Sales and Marketing: CRM integration, automated notifications of website enquiries, order summaries, automatic creation and delivery of KPIs, account placed on hold notifications. Automate upsell campaigns to existing customers.

- Customer Service integration: Automatic escalation of support queries, automated assignment of support tickets etc.

Digital transformation strategies during a recession can span across the whole business with minimal employee intervention. Automating a variety of process within multiple departments will reduce operational costs and improve productivity, both protecting your business against future cash flow issues. When integrating business systems, it’s recommended to follow system integration best practices to ensure a smooth implementation. For an extensive list of ways you can automate business processes, download the 200 ways to use BPA Platform brochure.

Planning your process automation project

Starting your business process automation project to overcome the challenges that businesses all over the world are facing can be a stressful time for many business leaders. Employee retention and cost-saving strategies during a recession are at the top of the list and choosing the right strategy is key.

To help ease the pressures on business leaders we have put together a BPA Project Management Workbook for you to work through along with over 200 business process automation examples to help you along the way. Additional areas for further process automation planning tips and ideas include:

- A Guide to BPA Project Management – Planning Your Implementation

- How Data Entry Automation Increases Company Revenue

- BPA Software – A Guide to Business Process Automation Software

- BPMN Approval Process Flow – Approval Workflow Examples

- What is Business Activity Monitoring Software?

- What is an Integration Platform and Why Do I Need One?

Our professional services team are business process experts and have a wealth of knowledge and experience in working with a wide range of industries and business systems and applications from software vendors such as SAP, Microsoft, Sage, Access Group, Epicor, SYSPRO and many more. In addition, we work closely with our global channel of partners that can help plan, build and deploy BPA Platform.

For more information on planning your business process automation strategy download the brochures below or call us on +44 (0) 330 99 88 700.

Download 200+ Examples Download Workbook