Creditsafe Salesforce Integration

Are you looking for a Creditsafe Salesforce integration solution to ensure your sales team has up-to-date credit information on customers and prospects when negotiating new deals? Or are you looking to provide your marketing department with improved insight into the financial health of an organisation and ensure company contact details are up to date with marketing preferences?

Codeless Platforms’ Creditsafe Salesforce integration solution provides you with the ability to integrate Salesforce with Creditsafe to automatically validate customer information, acquire credit scores and credit limits of existing customers and prospects to help you make informed business decisions.

Creditsafe Salesforce Integration Brochure

Creditsafe Salesforce integration features, scenarios and benefits

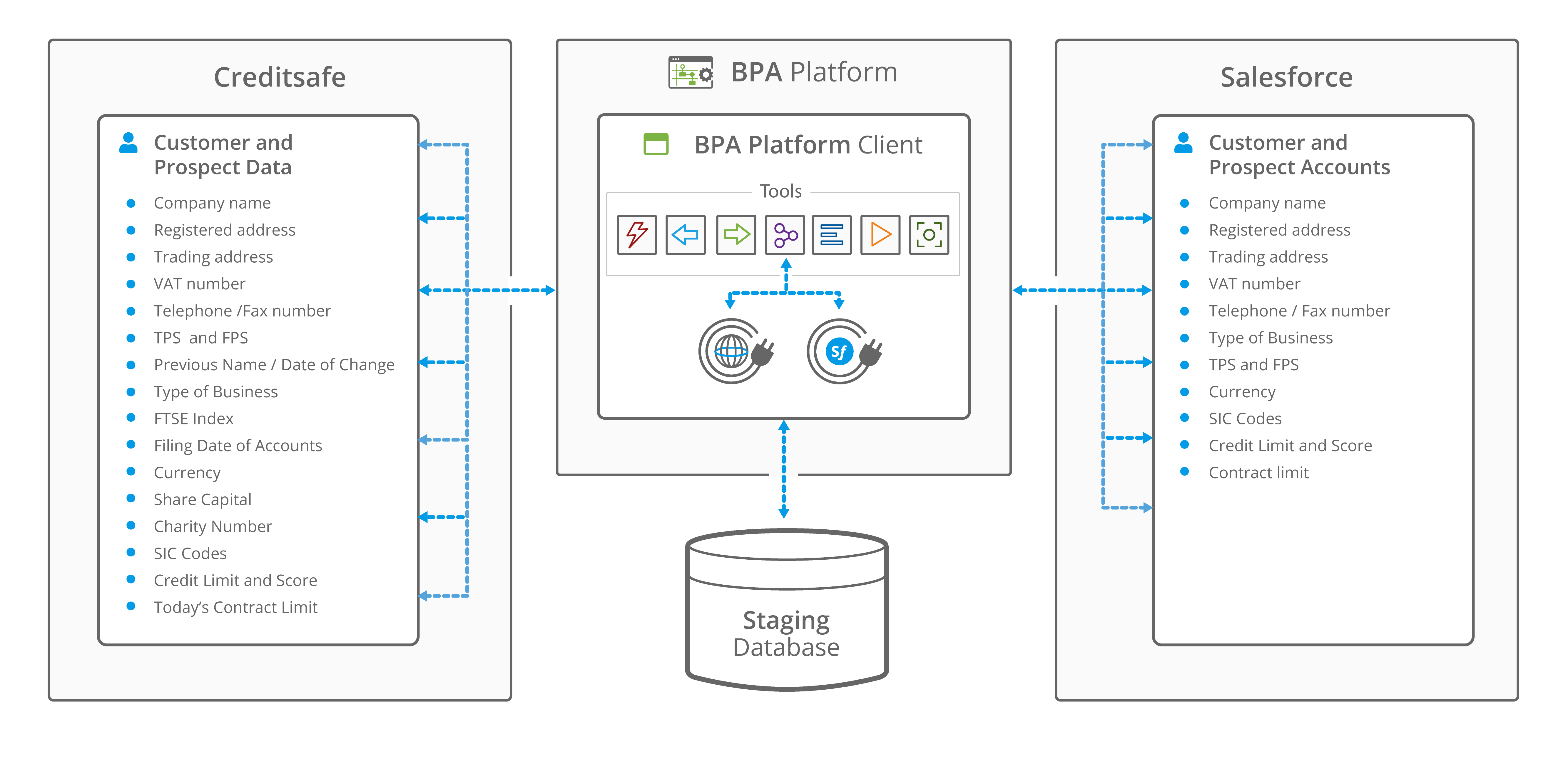

BPA Platform supports the central creation and management of an Integration Platform as a Service (iPaaS). It is designed specifically for channel partners and enterprise customers who wish to provide integration and automation as a service to internal and external customers. The Creditsafe API integration solution provides you with the ability to automatically pull company information from Creditsafe and place it into Salesforce, including information such as:

- Company name

- Registered address

- Trading address

- VAT number

- Telephone number

- TPS (Telephone preference service)

- Type of Business

- Previous Name / Date of Change

- FTSE Index

- Filing Date of Accounts

- Currency

- Share Capital

- Charity Number

- SIC Codes

- Credit Limit and Score

- Today’s Contract Limit

Image: A high-level system architecture overview of the Creditsafe Connector, with BPA Platform, Creditsafe and Salesforce

Creditsafe Salesforce integration example scenarios

The Creditsafe integration solution for Salesforce can be used for a range of different business processes within finance and sales and marketing departments. Common integration scenarios for Salesforce include:

Sales

Ensure sales teams get the most up to date information regarding existing customers and prospects when negotiating new deals including:

- Automatically retrieve and present 'New Account' information, e.g. company name, trading name, company VAT number etc. for existing customer records and prospects

- Automatically add credit scores and limits to company and prospect records to determine risk factors

- Automate the validation of contact preferences such as TPS or FPS

- Determine the age of an organisation and its trading history

Marketing

Improve marketing efforts by increasing the insight into the financial health of a business by making sure that all contact details are up to date and determining marketing preferences.

- Use the SIC code to identify companies within specific industries for marketing purposes. By determining the SIC code of your best clients, you can use this information to successfully acquire more customers within that industry

- Determine whether the company is growing and worth pursuing

- Ensure all telesales preference details are up to date before contacting

Commercial benefits of integrating Creditsafe with Salesforce include:

- Reduced exposure to credit risk

- Eradicate repetitive administration associated with credit referencing and data validation

- Enforce business rules and procedures

- Increased employee productivity

- Improved accuracy of business data

- Improved decision making

Frequently Asked Questions

Creditsafe Salesforce Integration Brochure

Subscription Pricing

Creditsafe Salesforce Integration

Software from

BPA Platform

£175

2100ROI Calculator

Use our simple ROI calculator to discover how much you could save each year through automation.