Managing data, documents and, especially, finances in organisations that have multiple subsidiaries can be incredibly complicated and resource-hungry. However, intercompany trading is an extremely important business process that organisations need to streamline in order to ensure that accounts, cash flow and performance are accurate and fully aligned, so that the organisation can make essential business decisions and comply with regulatory requirements.

What is intercompany trading?

Intercompany trading is extremely common in large multinational corporations that have multiple business units or subsidiaries operating in different regions or countries. These subsidiaries will often specialise in various aspects of the company’s operations, such as manufacturing, distribution or sales.

Intercompany trading essentially refers to the commercial transactions that take place between these different subsidiaries or divisions, involving the buying, selling, or exchanging of goods, services or financial assets. It enables companies to maximise their internal capabilities, achieve economies of scale, and effectively manage their global operations.

What are the reasons for intercompany transactions?

The reasons for intercompany trading can vary. It may be done to optimise the allocation of resources, streamline supply chains, or centralise certain functions within the organisation.

More importantly, it helps organisations standardise business processes and streamline transactions, such as replicating and transferring master data (chart of accounts, cost accounting master data, business partner information etc.), as well as transferring and creating sales and financial documents.

Intercompany integration can also be used for internal pricing and transfer pricing purposes, which involves setting prices for goods or services exchanged between related entities to reflect market value and to comply with tax regulations.

Accounting for intercompany trading is typically done through intercompany accounts, where the transactions between subsidiaries are recorded – known as financial consolidation. These accounts are used to track the flow of goods, services, or funds between the entities, ensuring accurate financial reporting and transparency within the organisation.

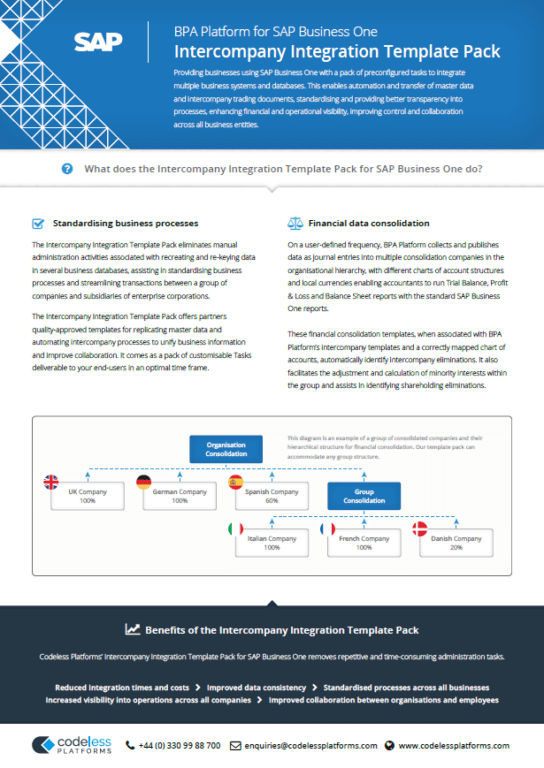

Download the Intercompany Integration Template Pack for SAP Business One data sheet

What is financial consolidation?

Financial consolidation is the process of combining the financial information of multiple entities within a company or a group of companies into a single set of consolidated financial statements.

The main reason for the consolidation of financial statements is to provide a comprehensive and accurate view of the financial position, performance and cash flows of the entire group. By consolidating the financial data, it becomes easier to assess the overall health of the organisation, make informed decisions and meet regulatory requirements.

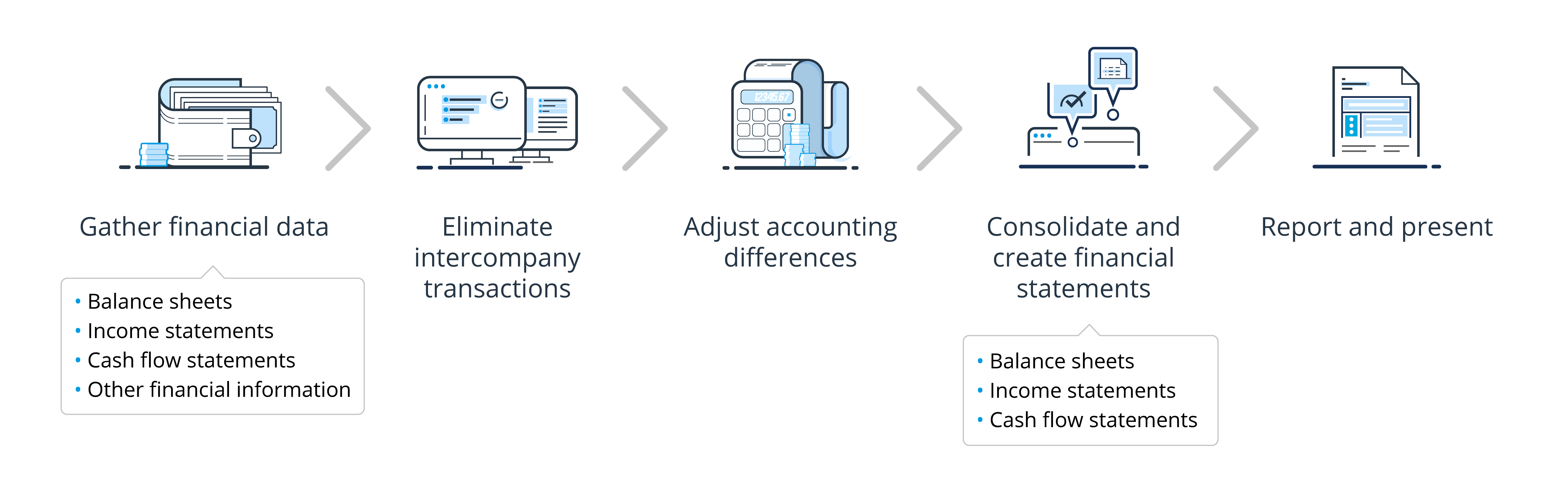

The financial consolidation process involves several steps, including:

- Gathering financial data: The financial statements of each company within the group are collected. This includes balance sheets, income statements, cash flow statements, and other relevant financial information.

- Eliminating intercompany transactions: Intercompany transactions, such as sales or loans between group entities, are eliminated to avoid double counting and ensure accuracy.

- Adjusting for accounting differences: If there are differences in accounting policies or practices among the companies, adjustments are made to ensure consistency in financial reporting.

- Consolidating financial statements: The financial data from all companies are combined to create consolidated financial statements, including a consolidated balance sheet, income statement, and cash flow statement.

- Reporting and disclosure: The consolidated financial statements are prepared and presented to stakeholders, such as investors, regulators, and management. These statements provide a holistic view of the group’s financial performance and position.

Financial consolidation helps to provide transparency, facilitate effective decision-making, and ensure compliance with accounting standards and regulatory obligations within a group of companies.

What is intercompany elimination?

An important aspect of financial consolidation is removing or offsetting the effects of transactions and balances between entities within the same group of companies during the consolidation process, known as intercompany elimination.

When consolidating financial statements, intercompany transactions and balances are eliminated to avoid double counting and to provide a more accurate picture of the group’s financial position and performance.

Intercompany transactions can include sales, purchases, loans, dividends, royalties, and other financial activities that occur between entities within the group. These transactions are initially recorded in the books of the respective companies, resulting in reciprocal entries on both sides of the transaction. For example, if Company A sells goods to Company B, Company A recognises the revenue, and Company B recognises the expense.

During the consolidation process, these intercompany transactions are eliminated to prevent their inclusion in the consolidated financial statements. The elimination is necessary because these transactions do not represent economic activities with external parties but rather internal transfers within the group.

Intercompany balances, such as intercompany loans or accounts receivable/payable between companies, are also eliminated. This ensures that only the balances with external parties are reflected in the consolidated financial statements.

The elimination process involves making journal entries to reverse the effects of the intercompany transactions. The specific elimination entries depend on the nature of the transactions and the applicable accounting standards. The goal is to remove the intercompany transactions and balances from the individual company financial statements, leaving only the transactions and balances that involve external parties.

By eliminating intercompany transactions and balances, the consolidated financial statements provide a more accurate representation of the group’s financial position, performance, and cash flows. It ensures that the financial statements reflect the economic activities of the group as a whole rather than the transactions between its internal companies.

When to use intercompany eliminations?

Intercompany eliminations are used when preparing consolidated financial statements for a group of companies. Here are some situations when intercompany eliminations are necessary:

- Consolidation of subsidiary entities: When a parent company has one or more subsidiary companies, the financial statements of these subsidiaries need to be consolidated with the parent company’s financial statements. Intercompany eliminations are used to remove the effects of intercompany transactions and balances between the parent and subsidiary companies.

- Group reporting: In a corporate group with multiple companies, each entity may maintain separate financial records and prepare individual financial statements. However, when presenting the financial position and performance of the entire group, intercompany eliminations are required to avoid duplication of transactions and provide a consolidated view.

- Compliance with accounting standards: Accounting standards, such as IFRS or UK GAAP, often require the elimination of intercompany transactions and balances in the consolidation process. These standards aim to ensure that the consolidated financial statements present a fair and accurate representation of the group’s financial position and performance.

- Internal control and management reporting: Intercompany eliminations are also important for internal control purposes. By eliminating intercompany transactions, management can assess the financial performance of individual companies and the overall group without distortion caused by internal transfers. This helps in making informed decisions and evaluating the performance of each company within the group.

- External reporting and stakeholder communication: Consolidated financial statements are typically shared with external stakeholders, such as investors, lenders, and regulatory authorities. Intercompany eliminations are necessary to provide stakeholders with a clear and accurate understanding of the group’s financial position and performance.

What is the calculation of minority interests?

The calculation of minority interests, also known as non-controlling interests (NCI), is another key component of the consolidation process when preparing consolidated financial statements. Minority interests refer to the portion of a subsidiary’s equity or net assets that is not owned by the parent company, but rather by external shareholders or non-controlling shareholders.

The purpose of presenting minority interests separately in the consolidated financial statements is to provide transparency and show the proportion of the subsidiary’s equity that is not owned by the parent company. This helps stakeholders understand the financial impact and ownership structure of the group as a whole.

To calculate minority interests, the following steps are typically followed:

- Determine the ownership percentage: The ownership percentage of the parent company in the subsidiary is determined. This is usually based on the direct ownership of shares or voting rights held by the parent company.

- Calculate the subsidiary’s net assets: The net assets of the subsidiary are calculated by adjusting its total assets and liabilities for any intercompany transactions and balances that need to be eliminated. This involves removing the effects of intercompany transactions, such as intercompany sales or loans, and eliminating any intercompany balances.

- Calculate the minority interest: The minority interest is calculated by multiplying the ownership percentage of the parent company by the subsidiary’s net assets. This represents the portion of the subsidiary’s equity or net assets that belongs to the non-controlling shareholders.

- Presentation in the consolidated financial statements: The minority interest is presented as a separate component in the consolidated balance sheet, under the equity section. It is usually reported below the parent company’s equity and is labelled as ‘Non-controlling Interests’ or ‘Minority Interests.’ The minority interest share of the subsidiary’s income is also presented in the consolidated income statement as a deduction from the consolidated net income.

It’s important to note that the calculation of minority interests is based on the ownership percentage of the parent company and represents the portion of the subsidiary’s equity attributable to non-controlling shareholders. It reflects their interest in the subsidiary’s assets, liabilities, and profits.

Taoglas Case Study

“We had an intercompany project that we wanted to develop. We soon realised that we could use BPA Platform as the basis for that project as it also has an intercompany module. We’ve taken that as a base version and modified it to our own internal processes. We’re now using BPA Platform to synchronise the data between the three different regions NASAC, EMEA, APAC, and we plan to sync the data between the different databases, such as currency synchronisation and master item synchronisation.” David Kelly, Head of ERP Applications, Taoglas

Pre-built intercompany solution reduces project schedule from months to weeks

Download Case Study

Intercompany trading solution for SAP Business One

Many large multinational corporations and their subsidiaries use SAP Business One to manage their sales, orders, finances, manufacturing and distribution.

In order to achieve even greater efficiency, these organisations should implement a dedicated solution that can integrate all these disparate SAP Business One systems and then automate the transfer of essential data and documents.

Codeless Platforms’ Intercompany Integration Solution for SAP Business One, via BPA Platform, provides a pack of quality-approved templates to achieve this. It helps eliminate manual administration activities associated with recreating and re-keying data in several business databases, assisting in standardising business processes and streamlining transactions between a group of companies and subsidiaries of enterprise corporations.

This includes:

- Converting purchase orders into sales orders

- Creating goods receipt POs from delivery notes

- Generating AP invoices from AR invoices

- Converting goods returns into sales returns

- Generating AP credit notes from AR credit notes

- Processing intercompany payments

Additionally, the intercompany template pack, when used with BPA Platform, also offers financial consolidation templates that can collect and publish data as journal entries into multiple consolidation companies in the organisational hierarchy, with different charts of account structures and local currencies. This enables accountants to run Trial Balance, Profit & Loss and Balance Sheet reports with the standard SAP Business One reports.

These financial consolidation templates, when associated with BPA Platform’s intercompany templates and a correctly mapped chart of accounts, automatically identify intercompany eliminations. It also facilitates the adjustment and calculation of minority interests within the group and assists in identifying shareholding eliminations.

Regardless of the ERP or accounting system being used, any organisation that operates with multiple subsidiaries needs to ensure that their intercompany trading and financial consolidation processes are accurate, efficient and transparent. This will help improve cash flow, enable effective decision-making and enforce compliance with accounting standards.

To learn more about the Intercompany Integration Solution for SAP Business One, or how automation can help with your intercompany trading and financial consolidation processes, download the data sheet below or call us on +44(0) 330 99 88 700.