An introduction to automated invoice processing

Automated invoice processing can reduce manual effort, improve accuracy and speed, and provide better visibility into the accounts payable process. It’s something that businesses really should consider implementing, especially in light of the current economic situation.

The introduction of mandatory eInvoicing in Europe for any business that conducts transactions with companies in the region is another significant factor that should ring alarm bells for any business that doesn’t employ digital invoicing.

What is accounts payable?

Accounts payable is the amount of money that a company owes to its suppliers for goods or services that it has purchased on credit, which it is expected to pay within a specified period of time.

Shown as a liability on a company’s balance sheet, accounts payable is a critical part of any organisation’s financial management as it affects a company’s cash flow and credit status, as well as its reputation and relationship with its suppliers and vendors.

In a typical accounts payable process, a company will receive invoices from its suppliers and the accounts payable department will verify that the goods or services have been received and that the amounts charged are correct. Once the invoices have been approved, the accounts payable department will record the amounts owed and make payments to the suppliers according to the payment terms agreed.

Why do accounts payable need invoice automation?

It’s been a turbulent few years for businesses, which is only set to continue due to rising costs and supply chain disruption around the globe. Effective management of cash flow and finances is therefore going to be critical for businesses to succeed.

Accounts payable departments, however, are often under great pressure and an unsurmountable amount of work, which isn’t helped by a multitude of inefficient manual processes.

Somewhat inexplicably in this digital age, the accounts payable process seems to be one of the contributing factors to cash flow and supply chain issues, with many organisations citing that approvals for invoices and payments take far too much time.

With invoices arriving in the post, by fax (yes, some organisations still rely on this), via email or through dedicated systems, the amount of time to process them all is extremely time-consuming and contributes to an ineffective situation that creates a certain amount of challenges and risk for the department.

Organisations that still rely on paper-based invoices are, unsurprisingly, the most susceptible to these challenges. Manually inputting data is not only time-consuming, but is also prone to human error, with incorrect data being uploaded, duplicated or omitted entirely. Invoices can also go missing if they are not logged, filed and stored correctly.

All of these factors leads to inconsistent, slow processing, that can hold up the entire accounts payable process.

Mandatory digital invoicing in Europe

Another factor that could have serious implications for any business that purchases from or supplies goods to countries in Europe is the forthcoming introduction of mandatory eInvoicing and EU digital reporting for any cross-border transactions, from 2025 and 2028 respectively.

Following legislative developments in France and Spain recently, this will be introduced a lot sooner.

A recent update from the French government confirmed mandatory eInvoicing and real-time reporting for VAT will be introduced on 1st July 2024. As a result, businesses will be required to fill and file electronic invoices for every B2B transaction.

Italy has already implemented this legislation, and Germany, Poland, Slovakia, Belgium and Romania are close behind.

Digitising and automating the invoicing process is therefore not only a strategically good move to help alleviate many of the issues involved in accounts payable, it will also be essential for many organisations.

Learn about Automation in Finance

What is automated invoice processing?

Automated invoice processing completely removes the manual, time-consuming process of extracting and uploading data from invoices received from vendors or suppliers.

The process involves capturing data from invoices, such as the vendor, amount and due date, and then using that information to automatically update financial systems and generate payments. This process eliminates manual data entry, reduces errors and delays, and can improve efficiency and accuracy in accounts payable operations.

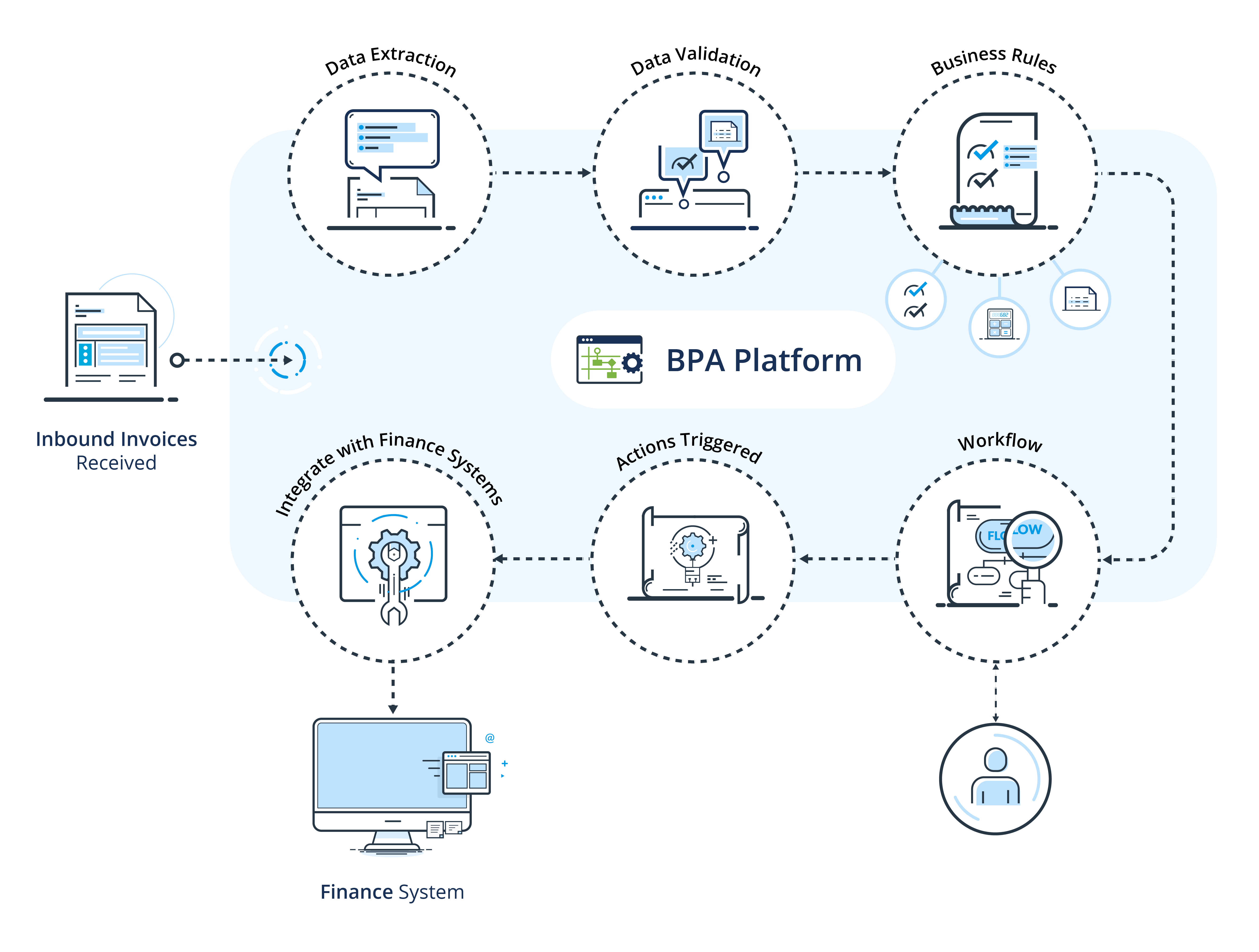

Invoice automation typically involves the following steps:

- Invoice generation: Invoices are generated automatically from an organisation’s financial or purchasing systems, reducing manual effort and minimising errors.

- Invoice receipt: Invoices are usually received electronically, via email, an EDI system or a web portal. These can then be automatically flagged for attention or forwarded for data extraction.

- Data extraction: Invoice data, such as company name and bank account number, can be automatically extracted using automated invoice processing software. This reduces time-consuming manual data entry and helps increase accuracy.

- Validation: The extracted data can then be automatically validated to ensure accuracy, and the system can flag any errors or missing information for manual review.

- Integration with financial systems: Invoice data can be automatically pushed into an organisation’s financial systems, again reducing manual data entry and improving accuracy.

- Approval and payment: Invoices can be automatically processed for approval and payment, reducing manual effort and improving speed.

Image: An example of an automated invoice processing flow using BPA Platform

What are invoice processing tools?

There are various invoice processing tools and software solutions available that can help streamline the process of receiving, processing, and managing invoices from suppliers.

They are designed to help organisations reduce manual effort, improve accuracy and speed, and provide better visibility into the accounts payable process.

Some common types of invoice processing tools include:

- Invoice management software: This type of software provides a centralised platform for organising and managing invoices. Products, such as SAP Concur and Zoho Invoice, can help reduce the risk of lost or misfiled invoices and improve the efficiency of the accounts payable process.

- Electronic invoicing (eInvoicing) solutions: These tools allow suppliers to submit invoices electronically, reducing the need for manual data entry and increasing speed.

- Payment automation solutions: These tools automate the process of generating and processing payments to suppliers, reducing manual effort and improving accuracy.

Whilst these tools can be extremely useful for managing invoices, they don’t always include some of the essential features required for completely automating the process.

Integration with accounting and ERP systems is an essential component that needs to be considered to provide a seamless and automated accounts payable process.

Additionally, approval workflows really needs to be automated. Invoices can then be routed for approval and payment, thus reducing manual effort and improving the speed of the accounts payable process.

A dedicated integration and automation platform, such as BPA Platform, can provide this functionality, as well as automate electronic invoicing and payment automation.

Benefits of automated invoice processing for accounts payable

Automating the invoice processing workflow, organisations can gain significant cost savings, improve accuracy and increase efficiency. It also provides better visibility into cash flow and supplier performance, and can help to ensure timely payment of invoices to suppliers.

- Improved efficiency: Automated invoice processing reduces manual effort and eliminates the need for manual data entry, resulting in significant time and cost savings. This not only removes the need for the accounting team to manually check and input each invoice, it also leads to faster turnaround times which can help improve supplier relations. Freeing up employees from mundane processing tasks also enables them to concentrate their time on higher value activities that can benefit the business.

- Increased accuracy: Automated invoice processing minimises human error and ensures that all invoices are processed consistently, reducing the risk of errors and increasing accuracy. Which again, can help improve supplier relations by reducing or eliminating late or missed payments.

- Improved visibility: Automated invoice processing provides real-time visibility into the status of invoices, enabling organisations to make informed decisions and improve cash flow management. This is paramount when other areas of the business rely on the information or it is required for analytical purposes in an ERP System.

- Better supplier relationships: Automated invoice processing helps organisations to pay suppliers on time, improving supplier relationships and reducing the risk of late payment penalties. It can also lead to better terms, discounts, and greater trust between the company and its suppliers.

- Cost savings: Automated invoice processing reduces the need for manual labour, which can result in significant cost savings. By automating the process, companies can also reduce the cost of paper-based invoices, printing and postage.

- Scalability: Automated invoice processing can easily accommodate increasing volumes of invoices, reducing the risk of backlogs and delays as an organisation grows.

- Streamlined reporting: Digitising invoices means that they can be stored in a database and made accessible from any location or accessed for reporting purposes, which can help with compliance.

- Compliance: Automated invoice processing ensures that all invoices are processed in accordance with established policies and procedures, reducing the risk of fraud and non-compliance.

- Data stored digitally: Storing invoices digitally eliminates the need to file and store paper-based documents in an office.

Overall, automated invoice processing offers a range of benefits to accounts payable, making the process faster, more accurate, and more cost-effective.

For more information on how business process automation can improve your accounts payable and finance processes, download the data sheet below or call us on +44(0) 330 99 88 700.